The Anti-Corruption Law Program (ACLP), a joint initiative of the Centre for Business Law at the Peter A. Allard School of Law at UBC, the Vancouver Anti-Corruption Institute, and Transparency International Canada, is pleased to announce an eight-week on-line course called “The Life Cycle of Dirty Money”. This unique anti-money laundering series is designed and coordinated by Jeffrey Simser, former Legal Director of the Ontario Ministry of the Attorney General. Each session will be held on seven consecutive Thursdays at 9:00 am PST (12 noon EST), from January 11 to February 22, 2024, with the final session being a hybrid in-person in Vancouver / online event on Wednesday, February 28 at 12:00 noon PST.

This 8-part course will qualify for up to 10 CPD credits from the Law Society of British Columbia.

Course Outline

Session 1: What is money laundering?

January 11, 2024

This session will explore the fundamental mechanics of money laundering: What is it? How does it work? How do we prevent it? How do we disrupt it? How does the underlying legal regime operate? How does money laundering link to corruption?

Moderator:

Jeffrey Simser, Course Coordinator and Barrister & Solicitor, Toronto

Panel:

- Stefan Cassella, CEO, Asset Forfeiture Law LLC, Maryland, USA

- Peter German, KC, President, International Centre for Criminal Law Reform (ICCLR), Vancouver

- Sanaa Ahmed, Ph.D., Assistant Professor, University of Calgary Law School, Calgary

This session qualifies for 1.5 CPD credits from the Law Society of British Columbia and 1.5 Professionalism Hours from the Law Society of Ontario.

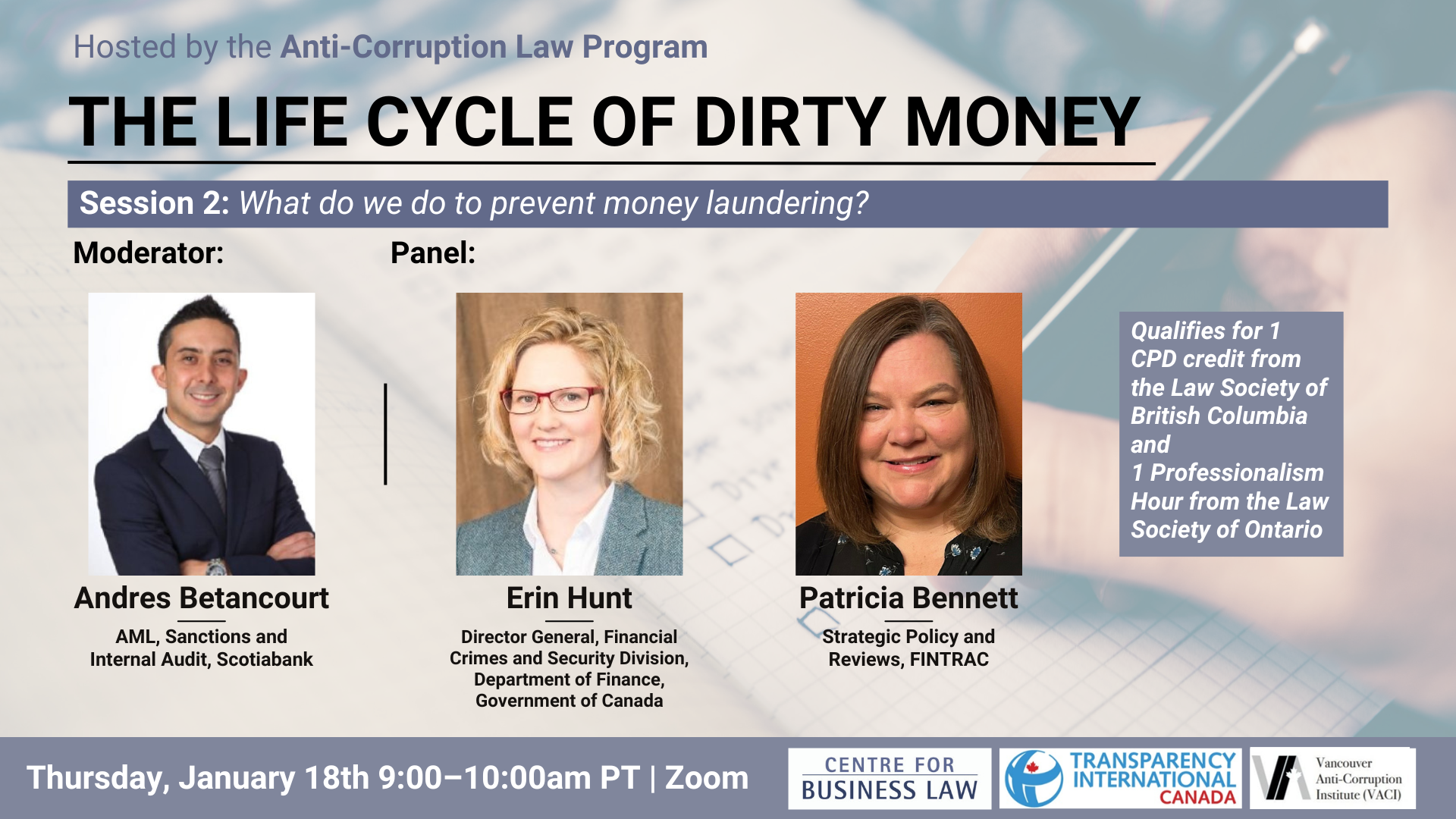

Session 2: What do we do to prevent money laundering?

January 18, 2024

In this session we will bring together FINTRAC, Canada’s financial intelligence unit and primary regulator for money laundering issues, along with a representative of the Department of Finance, who together are leading many of the policy changes on which the Government of Canada is consulting. The session will be moderated by an experienced industry expert.

Moderator:

Andres Betancourt, AML, Sanctions and Internal Audit, Scotiabank

Panel:

- Erin Hunt, Director General, Financial Crimes and Security Division, Department of Finance, Government of Canada

- Patricia Bennett, Strategic Policy and Reviews, FINTRAC

This session qualifies for 1 CPD credit from the Law Society of British Columbia and 1 Professionalism Hour from the Law Society of Ontario.

Session 3: Investigating and Prosecuting Money Laundering

January 25, 2024

When anti-money laundering prevention fails, we look to law enforcement to disrupt it through investigations, prosecutions, and asset forfeiture. These experts will discuss investigations, prosecutions, civil forfeiture proceedings, and their policy implications.

Moderator:

Melinda Murray, Director Civil Forfeiture, Manitoba Justice

Panel:

- Gary Valiquette, Guns and Gangs Prosecutor, Ministry of the Attorney General, Toronto

- Frank Mauti, Toronto Police Service, Proceeds of Crime (retired)

- M. Michelle Gallant, Ph.D., Professor, University of Manitoba Law School

This session qualifies for 1 CPD credit from the Law Society of British Columbia and 1 Professionalism Hour from the Law Society of Ontario.

Session 4: Crypto and Laundering

February 1, 2024

This session will feature a leading expert who will explain how cryptocurrency works, how it connects to criminal ecosystems, where the fiat currency off-ramps are, and what law enforcement can do about it.

Moderator:

Jeffrey Simser, Course Coordinator and Barrister & Solicitor, Toronto

Speaker:

- Amanda Wick, Principal, Incite Consulting and CEO of the Association for Women in Cryptocurrency, Washington

This session qualifies for 1 CPD credit from the Law Society of British Columbia and 1 Professionalism Hour from the Law Society of Ontario.

Session 5: International Oversight – the FATF Review Process

February 8, 2024

The Financial Action Task Force (FATF) sets standards for member countries and then conducts mutual evaluations to measure whether countries have the proper provisions in place, and how effective countries are at implementation. Canada will be evaluated in 2025.

Moderator:

Jeffrey Simser, Course Coordinator and Barrister & Solicitor, Toronto

Panel:

- Yehuda Shaffer, Principal, Risk-Based Consultancy, former head of Israel’s Financial Intelligence Unit (FIU)

- Maria Nizzero, Research Fellow, Royal United Services Institute, London, England

- Chantal Goupil, Team Leader, International Relations Unit, FINTRAC

This session qualifies for 1 CPD credit from the Law Society of British Columbia and 1 Professionalism Hour from the Law Society of Ontario.

Session 6: Litigating Asset Recovery for Victims

February 15, 2024

Victims have options to consider when faced with losses, including engaging legal practitioners. The experts featured in this session will speak to the challenges of following tainted assets in aid of their victim clients.

Moderator:

Stefan Cassella, Attorney and CEO, Asset Forfeiture Law LLC, Maryland

Attorney Panel:

- Steve Welk, Dentons, Los Angeles

- Lincoln Caylor, Bennett Jones, Toronto

This session qualifies for 1 CPD credit from the Law Society of British Columbia and 1 Professionalism Hour from the Law Society of Ontario.

Session 7: Corruption and the Lifecycle of Dirty Money

February 22, 2024

This session will discuss the broader challenges posed by corruption, connect those to the issue of money laundering, and then explore possible solutions.

Moderator:

Norman Baldwin, Partner, GRC Vista Risk Consulting

Panel:

- Christian Leuprecht, Ph.D., Director, Institute for Intergovernmental Relations, School of Policy Studies, Queens University, Kingston

- Jamie Ferrill, Ph.D., Discipline Lead, Financial Crime Studies, Charles Sturt University, Canberra, Australia

- Dwayne King, Senior Manager, Risk, Forensics and AML Advisory, Grant Thornton LLP Toronto

This session qualifies for 1.5 CPD credits from the Law Society of British Columbia and 1.5 Professionalism Hours from the Law Society of Ontario.

Session 8: Short-Circuiting the Lifecycle of Dirty Money

Thursday February 29, 2024 at 9:00am-10:30am PST

This culminating session will revisit questions from previous sessions. How do we prevent money laundering? How do we disrupt money laundering? What links money laundering and corruption? We’ll conclude the session with thoughts for the future.

Moderator:

Tammy Pryznyk, Director Civil Forfeiture, Saskatchewan

Panel:

- Cameron Field, Vice President, VIDOCQ

- Denis Meunier, President, DMeunier Consulting

- James Mallet, Director Civil Forfeiture, Alberta

- Jeffrey Simser, Barrister & Solicitor

- Oscar Solorzano, Head of Latin America, Basel Institute of Governance, Switzerland

This session qualifies for 1.5 CPD credits from the Law Society of British Columbia and 1.5 Professionalism Hours from the Law Society of Ontario.

This eight-part course is being presented by the Anti-Corruption Law Program, which is a joint continuing professional educational initiative of the Centre for Business Law at the Peter A. Allard School of Law at the University of British Columbia, Transparency International Canada, and the Vancouver Anti-Corruption Institute at the International Centre for Criminal Law Reform and Criminal Justice Policy, also at UBC.