Capital gains are a form of income that is both taxed at highly preferential rates and extremely concentrated at topmost incomes, thus undercutting the tax system’s progressivity. Several arguments have been made for continuing this tax preference, which is a major contributor to top-end inequalities and tax avoidance stratagems, but most of those arguments can be rebutted. Empirical evidence also weakens the argument that the capital gains tax preference is needed for an efficient and growing economy, and the gains preference actually harms the efficient allocation of economic resources. This study assesses the case for reforms that would increase the gains tax inclusion rate from the current 50 percent to 75 percent but restricted to taxpayers with total gains and/or incomes above specified high thresholds. Such reforms would be much more effective, raise far more revenues, and be much more transparent than the tepid changes affecting capital gains contained in the 2023 federal budget’s revisions of the Alternative Minimum Tax. The targeted changes proposed here would affect relatively few taxpayers and should receive wide public support.

This lecture qualifies for 1.5 CPD credits.

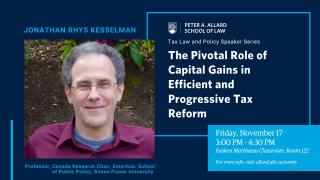

Speaker

- Graduate Programs

- General Public

- All Students

- Alumni

- Continuing Professional Development

- Faculty

- Staff

- Research Talks