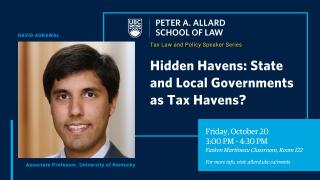

Tax Law and Policy Speaker Series

An international tax haven is usually a low-tax jurisdiction that seeks to attract investment by foreign investors. But, there are many state and local jurisdictions within federal systems that set zero tax rates on personal or corporate income, consumption, property, and wealth in an effort to attract activity from other high-tax jurisdictions. This paper discusses whether subnational tax havens are distinct from intense tax competition, and concludes that in a federal system, the economic implications of the two may be similar, but the policy responses differ subtly. A survey of the empirical evidence on the effect of zero or very low tax rates indicates that the lowest tax jurisdiction may disproportionately benefit from non-real base shifting, but real and avoidance responses also arise in response to smaller tax differentials between non-havens. Turning to the corporate income tax, the paper discusses how legal rules such as formula apportionment, economic nexus, and incorporation rules influence tax competition and the avoidance behaviours of multistate companies.

This lecture qualifies for 1.5 CPD credits.

This session is also available virtually. Please email Carlos Nunez (nunez@allard.ubc.ca) if you are interested in attending via Zoom.

Speaker

David R. Agrawal is an associate professor in the Martin School of Public Policy and Administration and in the Department of Economics at the University of Kentucky. He is also a fellow in the CESifo Research Network and editor in chief of International Tax and Public Finance. Agrawal’s research focuses on state and local tax policy, including theoretical and empirical models of fiscal competition and fiscal federalism. He is particularly interested in the welfare effects of decentralized policies, the effect of digitalization on subnational taxation, and the interjurisdictional mobility of tax bases. He has received both the Peggy and Richard Musgrave Prize and the Young Economists Award from the International Institute of Public Finance. Agrawal holds a PhD in economics from the University of Michigan, an MPP from the University of California–Berkeley, and a BA in economics and political science from the University of Connecticut.

- Graduate Programs

- General Public

- All Students

- Alumni

- Continuing Professional Development

- Faculty

- Staff

- Research Talks