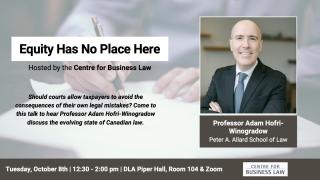

Should courts allow taxpayers to avoid the consequences of their own legal mistakes? Canadian law has first taken a strikingly liberal approach to granting rescission and rectification to reverse the tax results of failed, mistake-based tax planning, and later switched to a far more restrictive approach. Professor Adam Hofri-Winogradow will discuss the current state of Canadian law, and assess whether Canadian courts have struck an appropriate equitable balance in dealing with failed tax planning.

- Centre for Business Law

- All Students

- JD

- Student Events